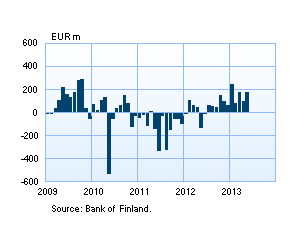

Finnish households’ investments in investment funds registered in Finland have been positive in net terms in each of the last 12 months. Household confidence in investment funds strengthened particularly in the first half of 2013, with net inflows of new capital from households for funds amounting to more than EUR 0.8 billion. The corresponding figure for the first half of 2012 was less than EUR 0.1 billion.

Fund capital The aggregate fund capital of investment funds registered in Finland grew strongly in the early part of the year. A majority (EUR 1.8 billion) of the fund capital growth of well over EUR 2.0 billion is accounted for by positive net subscriptions. In May, the aggregate fund capital reached an historical high of nearly EUR 71 billion. |

Finnish households’ net investments in investment |

|---|---|

In addition to households, those most active in investing assets in Finnish investment funds during the first six months of the year were domestic insurance corporations (EUR 0.6 billion) and domestic non-financial corporations (EUR 0.4 billion). Net investments of Swedish investors, in turn, were negative in the amount of EUR 0.9 billion. After Finnish investors, Swedish investors are the largest owner group of Finnish investment funds. The evolution of Swedish investors’ net investments is due, in part, to the cross-border migration of assets managed by domestic fund management companies. On the other hand, this trend has been alleviated by mergers of many Swedish investment funds with Finnish funds.

Investment of fund assets A significant portion of Finnish investment fund assets are invested outside the euro area (44%). Investments allocated to Sweden cover 14% of all investments. Investment funds have led to the internationalisation of domestic investor wealth, as only 29% of fund assets are invested domestically. During the first half of 2013, investment funds made debt security investments particularly in the euro area: EUR 1.4 billion in net terms was invested in debt securities issued by German, Italian, French and Spanish governments. Equity investments, in turn, were mainly focused outside the euro area. In particular, there were approximately EUR 1.0 billion worth of net investments in Japanese and US equities issued by non-financial corporations. Investments in debt securities issued by Finnish non-financial corporation reached an all-time high of EUR 3.4 billion at the end of June. In the first part of the year, as much as EUR 0.6 billion on net was invested in debt securities issued by Finnish non-financial corporations.

Key statistical data on investment funds registered in Finland, preliminary data

For further information, please contact:

Johanna Honkanen, tel. +358 10 831 2992, email: johanna.honkanen(at)bof.fi, Jori Oksanen, tel. +358 10 831 2552, email: jori.oksanen(at)bof.fi. The next investment fund news release will be published on 31 October 2013 at 13.

| |

Households’ fund investments increased in the first half of the year

Older news

Statistics

Wednesday 31 July 2013, 1:00 PM