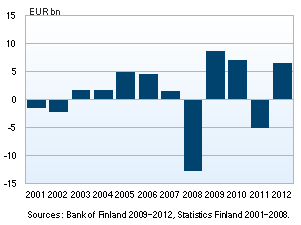

Investment funds reported EUR 6.6 bn profit for 2012Investment funds registered in Finland reported total profits of EUR 6.6 bn for the financial year 2012. This represented a significant turnaround from the previous year, for which investment funds reported losses of EUR 0.5 bn. As much as 93% of domestic investment funds recorded positive results, compared to 26% in 2011. | |

|---|---|

The financial results were positive for all fund categories. Equity funds and bond funds accounted for the bulk of the aggregate profit, EUR 5.9 bn. The jump in bond funds’ share of profits from previous years is explained by a change in the legal definition of money market funds as of January 2012. As a result of the change, a part of the capital of money market funds was shifted to bond funds.1

The positive financial result was mainly due to unrealised value appreciation of securities holdings (EUR 4.3 bn). A huge part of the positive result for 2012 derived from value appreciation of fund investments, especially shares. The result was also boosted by growth in other income2 which doubled on the previous year. Growth was also partly explained by the appreciation of the Swedish krona against the euro in 2012. Dividend income and income from fund shares (EUR 0.7 bn) as well as interest income (EUR 0.9 bn) remained at the previous year’s levels.

The financial result was negatively affected by investment fund expenses, which increased EUR 0.8 bn, to EUR 1.1 bn in 2012. The rise in expenses was driven largely by the other expenses item (EUR 0.5 bn), which doubled on 2011.3 Fees collected by fund management companies and custodians were unchanged from the previous year (EUR 0.6 bn). |

Net profit of investment funds 2001-2012

|

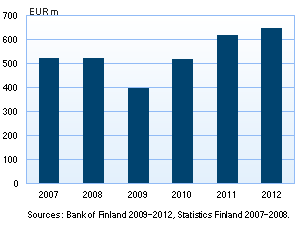

The aggregate fund capital of domestic investment funds grew by EUR 11 bn, totalling about EUR 67 bn at the end of 2012. EUR 6.6 bn of the growth was due to the financial profit. Investment funds also experienced new capital inflows in excess of redemptions, in net terms EUR 4.6 bn.4 Investment funds distributed profits of EUR 0.1 bn to their shareholders. At the end of 2012, there were 528 operating investment funds registered in Finland, administered by 32 fund management companies. 1 For more information on the change in the legal definition of money market funds (ECB regulation concerning the balance sheet of the monetary financial institutions sector ECB/2008/32, as amended with ECB/2011/12), see the Bank of Finland’s Financial Market Report 2/2011 (p. 17–19). 2 Other income includes eg premia on securities lending and remuneration corresponding to unpaid cash dividends as well as exchange rate gains from euro-conversion of foreign-currency financial assets.

3 Other expenses include eg interest expenses and exchange rate losses from euro-conversion of foreign-currency financial assets.

4 In the statistics on investment funds’ financial statement data, the item ‘subscriptions of investment fund shares’ includes small amounts of other adjustments.

More information:

Johanna Honkanen, tel. 010 831 2992, email: johanna.honkanen(at)bof.fi

Jori Oksanen, tel. 010 831 2552, email: jori.oksanen(at)bof.fi | |

Financial statements of investment funds, 2012 and key figures 1995-2012.xls

Financial statements of investment funds, 2012 and key figures 1995-2012.xls