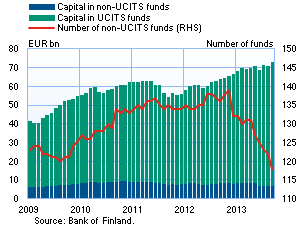

The number of non-UCITS funds domiciled in Finland has decreased by 18 funds over the past year. At end-September 2013, the capital in non-UCITS funds amounted to EUR 6.9 bn, or 9.5% of all investment funds domiciled in Finland. As recently as at the end of the first quarter of 2012, non-UCITS funds managed about 14% of all investment fund assets. The decrease in the number of non-UCITS funds reflects tightening financial market regulation, namely, the AIFM Directive: the main reason for the reduction in the capital in non-UCITS funds is the reclassification of many non-UCITS funds as UCITS funds.

Fund capital In September 2013, the aggregate fund capital reached a historical high of nearly EUR 73 bn. Fund capital increased during the third quarter of the year by EUR 4.1 bn, of which EUR 1.7 bn reflected positive net subscriptions and EUR 2.3 bn capital appreciation. |

Capital in investment funds registered in Finland and |

|---|---|

A majority of the new capital of EUR 1.7 bn came from domestic investors (EUR 1.2 bn). Investment funds made significant (EUR 0.6 bn) net investments in other Finnish investment funds. Domestic insurance corporations and employment pension institutions were also active net investors in Finnish investment funds (EUR 0.5 bn). At the same time, net investments by Finnish households were moderate, slightly below EUR 0.1 bn. Significant net investments in investment funds were also made by Swedish investors, totalling EUR 0.5 bn. Swedish investors are the largest owner group of Finnish investment funds after Finnish investors.

Investment of fund assets In the third quarter of 2013, Finnish investment funds invested particularly in securities issued by non-financial corporations: almost EUR 0.8 bn was invested in equity and about EUR 0.4 bn in debt securities. Investments in non-financial corporations focused on securities issued by French, German and US corporations. Investment funds were also active in the sovereign debt security markets. Investments in debt securities issued by governments amounted to EUR 0.4 bn in net terms. These investments concentrated particularly on debt securities issued by the German and Belgian governments. At the same time, investment funds withdrew assets from debt securities issued by the French, Italian and Swedish governments. In addition, investment funds invested EUR 0.6 bn in securities issued by deposit banks. Key statistical data on investment funds registered in Finland, preliminary data

For further information, please contact:

Johanna Honkanen, tel. +358 10 831 2992, email: johanna.honkanen(at)bof.fi, Jori Oksanen, tel. +358 10 831 2552, email: jori.oksanen(at)bof.fi. The next investment fund news release will be published on 31 January 2014 at 13.

| |

Number of non-UCITS funds decreased over the past year

Older news

Statistics

Thursday 31 October 2013, 1:00 PM