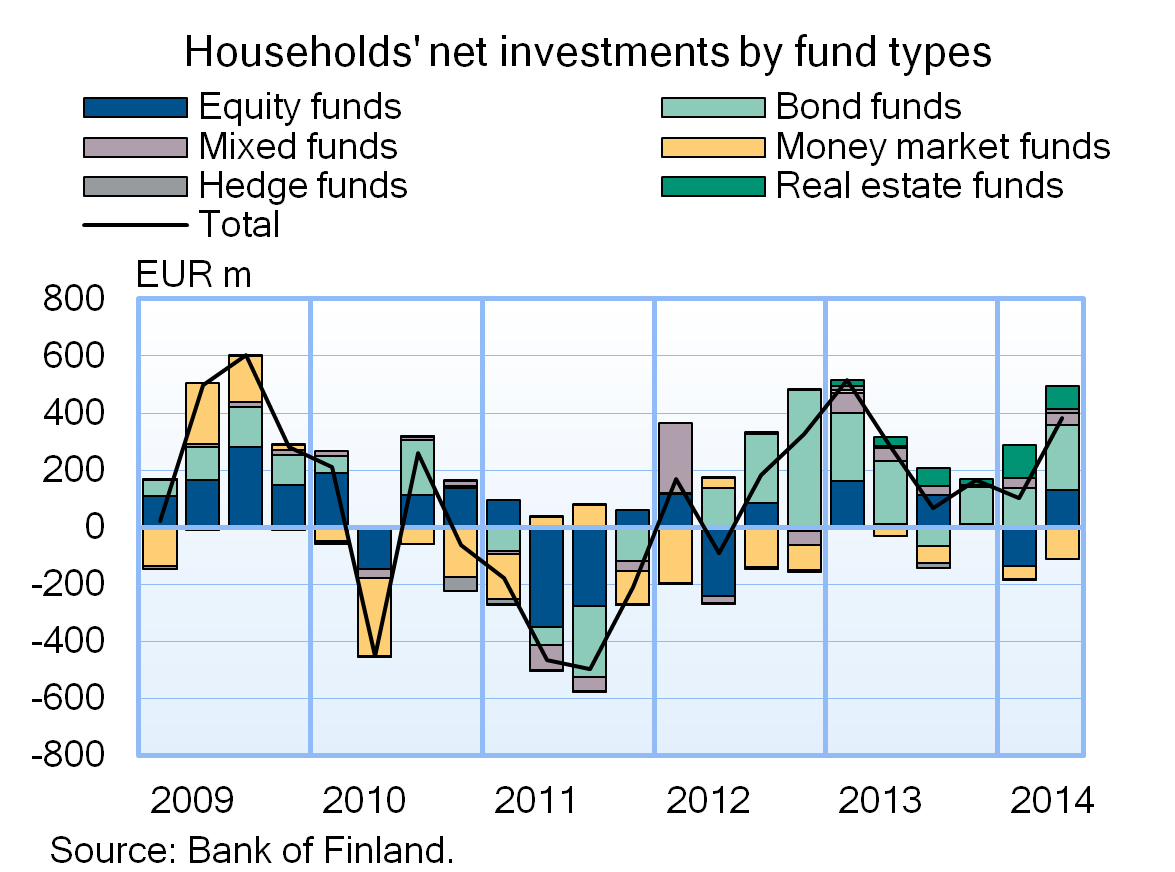

In the second quarter of 2014, Finnish households' investments in investment funds registered in Finland amounted to EUR 0.4 bn, on net. Investments were up on the first quarter, when new capital inflows into investment funds from the household sector totalled EUR 0.1 bn. Differences between the quarters can also be observed when looking at households' fund investments by fund type. While households' net investments in equity funds were negative in the first quarter, they turned positive in the second quarter. By contrast, households have been liquidating their investments in money market funds, which are considered to involve the lowest level of risk, throughout the early part of the year. With deposit rates continuing to fall, households have turned to higher-risk fund investments as a means of preserving asset value while seeking additional return. |

|

Record growth in fund capital in May The aggregate fund capital of investment funds continued to grow and reached a record high of EUR 82.6 bn at the end of the second quarter. During the second quarter, fund capital increased by EUR 5.2 bn, with a good half (EUR 2.8 bn) of the growth occurring in May. Such strong monthly growth in fund capital has not been seen previously. Of the second-quarter growth, EUR 2.9 bn was accounted for by new capital inflows. The rest of the increase (EUR 2.3 bn) reflected appreciation of investments. In addition to households, Finnish insurance corporations invested actively in Finnish-registered investment funds. In net terms, these investments amounted to EUR 0.8 bn in the second quarter of 2014. A significant proportion of insurance corporations' fund holdings are related to unit-linked insurance policies, so that these holdings are, in fact, assets of households and other policy holders. Swedish investors also invested significant amounts of new capital in investment funds, with their investments totalling EUR 0.9 bn, on net. |

Portfolio investments in the United States and Sweden increased In the second quarter of 2014, Finnish investment funds' equity investments were mainly directed at the US and Swedish markets, totalling EUR 0.8 bn, on net. Investments in debt securities in turn went mainly into Europe: net investments in debt securities issued by the Italian, Swedish and Belgian governments totalled EUR 0.2 bn. Finnish investment funds liquidated some of their portfolio investments, particularly debt securities issued by the German and French governments and by domestic and Danish non-financial corporations. |

Key statistical data on investment funds registered in Finland, preliminary data |

For further information, please contact:

Johanna Honkanen, tel. +358 10 831 2992, email: johanna.honkanen(at)bof.fi.

The next investment fund news release will be published on 31 October 2014 at 1 pm. |