|

|

|

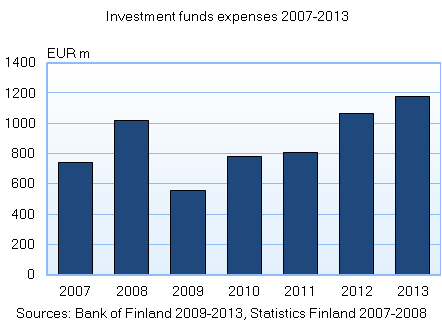

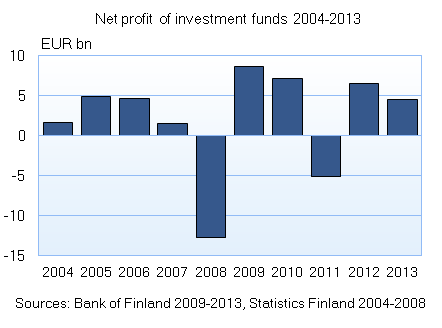

The positive financial result was mainly due to capital gains from securities transactions and unrealised value appreciation of securities holdings. Realised securities transactions made a net contribution of EUR 2.2 bn to the result, and unrealised value appreciation for securities holdings was reported at EUR 1.5 bn. Dividend income from shares, income from fund shares and interest income remained at the previous year’s level and boosted the financial result by EUR 1.6 bn. The result was also pushed up by other income1 which totalled EUR 0.3 bn. The financial result was negatively affected by investment fund expenses, which increased EUR 0.1 bn from the previous year, to EUR 1.2 bn in 2013. Fees paid to fund management companies and custodians totalled EUR 650 m, compared to EUR 580 m in 2012. The item consists mainly of administrative fees paid to fund management companies. Other expenses2 amounted to EUR 530 m. |

|

|

|

|

|

The aggregate fund capital of domestic investment funds grew by EUR 8.6 bn during the year, totalling about EUR 75 bn at the end of 2013. About half of the growth (EUR 4.2 bn) was due to new capital inflows.3 Profits for the financial year, in turn, boosted the aggregate fund capital by EUR 4.6 bn. As in the previous year, investment funds distributed profits of EUR 0.1 bn to their shareholders in 2013. At the end of 2013, there were 517 operating investment funds registered in Finland, administered by 31 fund management companies. The Bank of Finland annually publishes a statistical release "Investment funds' financial statement data". The data are collected directly from investment funds registered in Finland. The publication also uses data from monthly balance sheet reporting by investment funds to the Bank of Finland.

_____________________________________

|

|