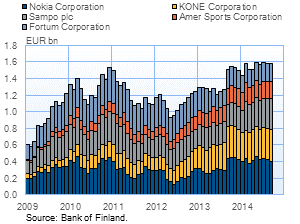

The largest equity investments of investment funds registered in Finland were in Nokia, Kone and Sampo. At the end of September 2014, the balance sheet value of these investments totalled approximately EUR 1.2 bn. At that time, 52 Finnish investment funds had holdings in Nokia, 57 had investments in Kone and 53 in Sampo. Investment funds registered in Finland had investments in the listed shares of a total of 113 of the various Finnish non-financial corporations. Nearly one-fifth of investment funds' equity holdings were Finnish. At the end of September, investments in listed shares by investment funds registered in Finland amounted to approximately EUR 29.1 bn, which is ca 33% of the funds' total assets. Investment funds had holdings of listed shares of approximately 4,500 institutions in 94 countries. |

|

Fund capital continued to grow in the third quarter 2014 The aggregate fund capital of investment funds was EUR 84.2 bn at the end of the third quarter 2014, i.e., aggregate fund capital was EUR 1.6 bn higher than at the end of the second quarter.Growth in fund capital was slower than in the early part of the year. The slower growth was mainly due to a fund merger arrangement in September, in which assets managed by a Finnish management company were transferred to Sweden. Of the growth, one-third was accounted for by new capital inflows, the rest by the appreciation of investments. Of the investor sectors, the largest investments in Finnish-registered investment funds in the third quarter were made by Finnish insurance corporations. In net terms, their fund investments amounted to approximately EUR 0.9 bn. Finnish households' direct fund investments totalled EUR 0.3 bn, on net. In the third quarter, investments from abroad were negative, on net (EUR -1.2 bn). |

Portfolio investments in the United States and Germany increased In the third quarter of 2014, Finnish investment funds' investments in debt securities went mainly into the United States and Germany: net investments in debt securities issued by commercial banks in the United States totalled EUR 0.1 bn, and those in debt securities issued by the German government totalled EUR 0.2 bn. New equity investments, in turn, were mainly directed at the US markets, totalling EUR 0.2 bn, on net. In the third quarter, portfolio investments into Sweden were negative on net, which was mainly due to the above-mentioned merger arrangements. |

Key statistical data on investment funds registered in Finland, preliminary data |

For further information, please contact:

Johanna Honkanen, tel. +358 10 831 2992, email: johanna.honkanen(at)bof.fi The next investment fund news release will be published on 30 January 2015 at 1 pm. |