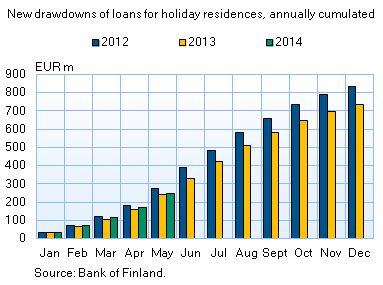

In the early part of 2014, new drawdowns of loans for holiday residences were slightly up on the corresponding period a year earlier. Demand for holiday residence loans is higher during the summer months, generally peaking in May–September. In May 2014, the stock of loans for holiday residences granted by credit institutions amounted to EUR 3.2 bn, increasing at an annual growth rate of almost 4.7%. In fact, holiday residence loans increased considerably faster year-on-year than the stock of housing loans, which grew at an annual growth rate of 2.1% in May. Holiday residence loans account for about 3% of all household loans. In statistics, loans for holiday residences are recorded in the loan purpose category ‛other loans’. The interest rate on holiday residence loans has been slightly higher than the rate on housing loans. In May, the average interest rate on the stock of holiday residence loans was 1.78%, and the average interest rate on new drawdowns was 2.24%. The average interest rate on the stock of housing loans, in turn, was 1.54%, and the average interest rate on new drawdowns was 2.00%. |

|

Loans In May 2014, households’ new drawdowns of housing loans amounted to EUR 1.4 bn. The average interest rate on new housing-loan drawdowns was 2.00%, slightly down on April. At the end of May, the stock of euro-denominated housing loans totalled EUR 88.8 bn and the annual growth rate of the stock was 2.1%. At end-May, household credit comprised EUR 13 bn in consumer credit and EUR 15 bn in other loans. New drawdowns of loans to non-financial corporations (excl. overdrafts and credit card credit) amounted in May to EUR 2.2 bn, which is almost as much as in May 2013. The average interest rate on new corporate-loan drawdowns rose from April, to 2.28%. At end-May, the stock of euro-denominated loans to non-financial corporations was EUR 66.1 bn, of which loans to housing corporations accounted for EUR 19.7 bn. | ||||||||||||||||||||||||||||||||||||||||||

Deposits At the end of May, the stock of household deposits totalled EUR 82 bn. The average interest rate on the stock was 0.44%. Overnight deposits accounted for EUR 53.3 bn and deposits with agreed maturity for EUR 15.1 bn of the total deposit stock. In May, households concluded EUR 1.3 bn of new agreements on deposits with agreed maturity. The average interest rate on these was 1.15%. Notes: | ||||||||||||||||||||||||||||||||||||||||||

1 Rate of change has been calculated from monthly differences in levels adjusted for classification and other revaluation changes. | ||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||

For further information, please contact: The next news release will be published at 1pm on 1 July 2014. |