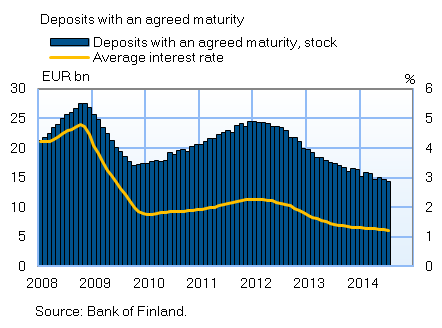

The stock of household deposits decreased in Finland by EUR 0.5 bn in the first half of the year. The decrease in the stock is particularly due to weak developments in fixed-term deposits. The stock of fixed-term deposits was only EUR 14.4 bn in July, compared to nearly EUR 20 bn at the end of 2012. Interest rates on new fixed-term deposits have been low, and the number of new fixed-term deposits has been modest. In an environment of low market interest rates, the share of other investments, for example fund investments, in household investments has increased, and there has been an outflow of money from fixed-term deposits in particular. Households have also converted assets into overnight deposits. |

|

Loans Households' new drawdowns of housing loans in July 2014 amounted to EUR 1.3 bn. The average interest rate on new housing-loan drawdowns was 1.90%, down by 0.02 percentage point on June. The stock of euro-denominated housing loans to households amounted to EUR 89.1 bn at the end of July and the annual growth of the stock of housing loans was 1.8%. At the end of July, household credit comprised EUR 13.5 bn in consumer credit and EUR 15.4 billion in other loans. New drawdowns of loans to non-financial corporations (excl. overdrafts and credit card credit) amounted to EUR 1.7 bn in July, which is EUR 0.6 bn less than in July 2013. The average interest rate on new loans to non-financial corporations rose from June, to 2.23% in July. The stock of euro-denominated loans to non-financial corporations was EUR 66.3 bn at the end of July, of which loans to housing corporations accounted for EUR 20.1 bn. | ||||||||||||||||||||||||||||||||||||||||||

Deposits At the end of July 2014, the stock of household deposits totalled EUR 81.5 bn, and the average interest rate on the stock was 0.42% Overnight deposits accounted for EUR 53.4 bn and fixed-term deposits for EUR 14.4 bn of the deposit stock. In July, households concluded new fixed-term deposit contracts for EUR 1.0 bn. The average interest rate on new fixed-term deposits was 1.13% in July. Notes: | ||||||||||||||||||||||||||||||||||||||||||

1 Rate of change has been calculated from monthly differences in levels adjusted for classification and other revaluation changes. | ||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||

For further information, please contact: The next news release will be published on 30 September 2014 at 1.00 pm. |