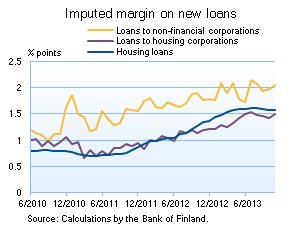

Interest rates on new housing loan agreements remained around 2% throughout the year 2013, and the imputed interest margin on housing loans declined slightly from its peak of 1.61% in August to 1.57% in November. Margins on new corporate loan agreements have, however, continued to widen. The imputed interest margin on corporate loans (excl. housing corporation loans) had risen by 0.3 of a percentage point since the summer to 2.04% in November. Margins on housing corporation loans remained around 1.5% throughout the autumn of 2013.

Interest rates on new housing loan agreements remained around 2% throughout the year 2013, and the imputed interest margin on housing loans declined slightly from its peak of 1.61% in August to 1.57% in November. Margins on new corporate loan agreements have, however, continued to widen. The imputed interest margin on corporate loans (excl. housing corporation loans) had risen by 0.3 of a percentage point since the summer to 2.04% in November. Margins on housing corporation loans remained around 1.5% throughout the autumn of 2013.

In Finland, the average interest rate on the housing loan stock declined further from 1.59% at the beginning of the year to 1.45% in the summer. After that, the average interest rate on the housing loan stock remained almost unchanged until November. Short-term market interest rates have remained at low levels, which is reflected in the average interest rate on the housing loan stock. The bulk of Finnish residents' housing loans have an initial rate fixation period of up to one year and are mainly tied to Euribor rates.

Loans

In November 2013, households’ new drawdowns of housing loans amounted to EUR 1.2 bn, which is EUR 0.4 bn less than a year earlier in November. The average interest rate on new housing-loan drawdowns in November was 2.0%, ie slightly down on October 2013. Outstanding euro-denominated housing loans to households amounted to EUR 88.3 bn at the end of November and the average interest rate was 1.47%. The annual growth rate of the housing loan stock moderated further, to 2.6%. At the end of November, household credit comprised EUR 13 bn in consumer credit and EUR 15 bn in other loans.

New drawdowns of loans to non-financial corporations (excl. overdrafts and credit card credit) amounted to EUR 2.5 bn in November, which is about EUR 0.5 bn less than in November 2012. The average interest rate on new corporate-loan drawdowns increased slightly from October, to 2.15%. The stock of euro-denominated loans to non-financial corporations at the end of November was EUR 66.4 bn, of which loans to housing corporations accounted for EUR 17.8 bn. The annual growth rate of the euro-denominated corporate loan stock picked up to 6.2% in November.

Deposits

At the end of November, the stock of household deposits totalled EUR 81 bn. The average interest rate on the stock was 0.48%. Overnight deposits accounted for EUR 50.7 bn and deposits with agreed maturity for EUR 16.5 bn of the total deposit stock. In November, households concluded EUR 1.7 bn of new agreements on deposits with agreed maturity. The average interest rate on these was 1.11%.

Notes:

MFIs comprise all monetary financial institutions operating in Finland.

Loans and deposits comprise all euro-denominated loans and deposits vis-à-vis the euro area as a whole, with countries other than Finland accounting for a very small share of total volumes.

Key figures of Finnish MFIs' loans and deposits, preliminary data

| September, EUR million |

October EUR million |

EUR million |

November, 12-month change1, %

|

Average interest rate, % | |

| Loans to households2, stock | 116,171 | 116,378 | 116,625 | 2.3 | 1.88 |

| - of which housing loans | 87,941 | 88,156 | 88,367 | 2.6 | 1.47 |

| Loans to non-financial corporations2, stock | 65,839 | 65,603 | 65,365 | 6.2 | 1.95 |

| Deposits by households2, stock | 81,666 | 81,049 | 81,243 | -0.3 |

0.48 |

| Households' new drawdowns of housing loans | 1,331 | 1,358 | 1,221 | – | 2.00 |

1 Rate of change has been calculated from monthly differences in levels adjusted for classification and other revaluation changes.

2 Households also include non-profit institutions serving households; non-financial corporations also include housing corporations.

- Euro-denominated deposits and loans of euro area residents: stock, 12 month rate of change and average interest rate

- Euro-denominated loans and deposits of Finnish households

- New business on loans and new drawdowns of household loans

- Finnish contribution to the euro area monetary aggregates and their main counterparts

- Analytical accounts of the banking sector (MFIs) in Finland

For further information, please contact:

Jaakko Suni, tel. +358 10 831 2454, email: jaakko.suni(at)bof.fi,

Essi Tamminen, tel. +358 10 831 2395, email: essi.tamminen(at)bof.fi.

The next news release will be published at 1 pm on 31 January 2014.

Related statistical data and graphs are also available on the Bank of Finland website:

http://www.suomenpankki.fi/link/2331b6266da3492f832ec75e0f654bd9.aspx?epslanguage=en.