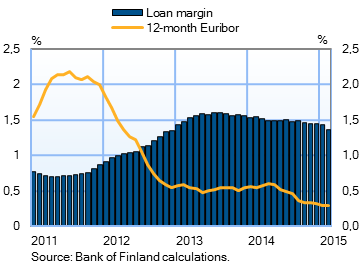

Since February 2015, credit institutions have marketed amortisation-free periods for housing loan customers, free of charge. The purpose has been to offer customers flexibility in the management of personal finances and to increase households’ consumption and savings possibilities. Households’ interest in amortisation-free periods has been strong. In February 2015, households renegotiated EUR 3.2 bn worth of housing loan agreements, compared to renegotiations averaging typically about EUR 0.2 bn per month. In addition to agreements for amortisation-free periods, renegotiated agreements also include loans for which the existing terms and conditions (e.g. the housing loan margin) are renegotiated. For households, the use of amortisation-free periods means postponements of loan repayment. Low interest expenses motivate housing-loan customers to extend their loan repayment schedules. The actual interest rate on new housing loan agreements has declined by 0.6 percentage point from a year earlier, to 1.4% at the end of February. The actual interest rate consists of a reference rate plus the bank’s margin. The average housing loan margin calculated by the Bank of Finland has also narrowed from a year earlier, to 1.37% in February. |

|

In February 2015, new drawdowns of housing loans amounted to EUR 1.2 bn. The average interest rate on new housing-loan drawdowns was 1.60%, slightly less than in January. At the end of February, the stock of euro-denominated housing loans totalled EUR 89.9 bn, and the annual growth rate of the stock was 1.9%. At end-February, household credit comprised EUR 13.5 bn in consumer credit and EUR 15.6 bn in other loans. New drawdowns of loans to non-financial corporations (excl. overdrafts and credit card credit) amounted in February to EUR 1.6 bn, which was EUR 0.3 bn less than in February 2014. The average interest rate on new corporate-loan drawdowns increased further in February, to 2.57%. At end-February, the stock of euro-denominated loans to non-financial corporations was EUR 69.5 bn, of which loans to housing corporations accounted for EUR 21.5 bn. | ||||||||||||||||||||||||||||||||||||||||||

At the end of February, the stock of household deposits totalled EUR 80.9 bn and the average interest rate on the deposits was 0.36%. Overnight deposits accounted for EUR 55.7 bn and deposits with agreed maturity for EUR 12.0 bn of the total deposit stock. In February, households cocluded EUR 0.7 bn of new agreements on deposits with agreed maturity. The average interest rate on these was 1.07%. Notes: | ||||||||||||||||||||||||||||||||||||||||||

Key figures of Finnish MFIs' loans and deposits, preliminary data

1 Rate of change has been calculated from monthly differences in levels adjusted for classification and other revaluation changes. | ||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||

For further information, please contact: The next news release will be published at 1 pm on 30 April 2015. |