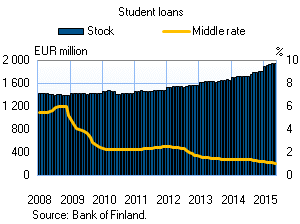

In the early part of the year, students have applied for more study loans than before. In January–May, students’ drawdowns of study loans totalled EUR 184 million, compared with EUR 123 million in the year-earlier period. Drawdowns typically peak in August and in January, when new tranches of study loans become available for drawdown. According to Statistics Finland’s Education Statistics, the number of employed students has decreased, which helps explain the rebound in the demand for study loans. On the other hand, changes in study grants, effective since autumn 2014, particularly student loan compensation, (i.e. a portion of study loan paid by Kela, the Social Insurance Institution of Finland) for new higher education students, have increased students’ willingness to take out study loans. The low level of interest rates on study loans may also have boosted the demand. The average interest rate on new study-loan drawdowns was at a record low, 0.94%, in May 2015. Overall, the total amount of study loans outstanding was EUR 1.9 bn, and the average interest rate on them 1.09%. |

|

Loans In May 2015, households’ new drawdowns of housing loans amounted to EUR 1.5 bn, which is nearly as much as a year earlier in May. The average interest rate on new housing-loan drawdowns was 1.50% in May. The stock of euro-denominated housing loans totalled EUR 90.5 bn at the end of May, and the annual growth rate of the housing-loan stock was 1.9%. At end-May, household credit comprised EUR 13.7 bn in consumer credit and EUR 15.7 bn in other loans. New drawdowns of loans to non-financial corporations (excl. overdrafts and credit card credit) amounted in May to EUR 3.2 bn. The average interest rate on new corporate-loan drawdowns remained the same as in April and was 1.80%. At end-May, the stock of euro-denominated loans to non-financial corporations was EUR 70.6 bn, of which loans to housing corporations accounted for EUR 22.2 bn. | ||||||||||||||||||||||||||||||||||||

Deposits At the end of May, the stock of household deposits totalled EUR 82.2 bn, and the average interest rate on the deposits was 0.34%. Overnight deposits accounted for EUR 57.3 bn and deposits with agreed maturity for EUR 11.5 bn of the total deposit stock. In May, households concluded EUR 0.5 bn of new agreements on deposits with agreed maturity. The average interest rate on new deposits with agreed maturity decreased from April, to 0.98% in May. Notes: | ||||||||||||||||||||||||||||||||||||

Key figures of Finnish MFIs' loans and deposits, preliminary data

1 Rate of change has been calculated from monthly differences in levels adjusted for classification and other revaluation changes. | ||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||

For further information, please contact: The next news release will be published at 1 pm on 30 June 2015. |