In the last quarter of 2022, households drew down EUR 80 million of unsecured consumer credit from other financial institutions (OFIs),[1] which was a little more than in the corresponding period a year earlier. The average agreed annual interest rate on new unsecured consumer credit was 9.3%. Almost a quarter of the consumer credit was drawn down from consumer credit and small-loan companies. The average interest rate on these drawdowns was 20%.

The stock of consumer credit originated by consumer credit and small-loan companies, also known as payday lenders, decreased, and the average interest rate declined in 2022.[2] At the end of December 2022, the stock of consumer granted by consumer credit and small-loan companies to Finnish households stood at EUR 154 million, with an average interest rate of 35%. Payday lenders’ stock of consumer credit has contracted significantly since 2018, when payday lenders had an estimated EUR 700 million of loan receivables from households. In September 2019, a 20%-interest rate cap on consumer credit entered into force, after which some of the companies granting small loans have discontinued either the extension of new loans or their activities altogether. The contraction of the loan stock also reflects the sale of loans off balance sheets.

Other financial institutions originate the majority of vehicle loans

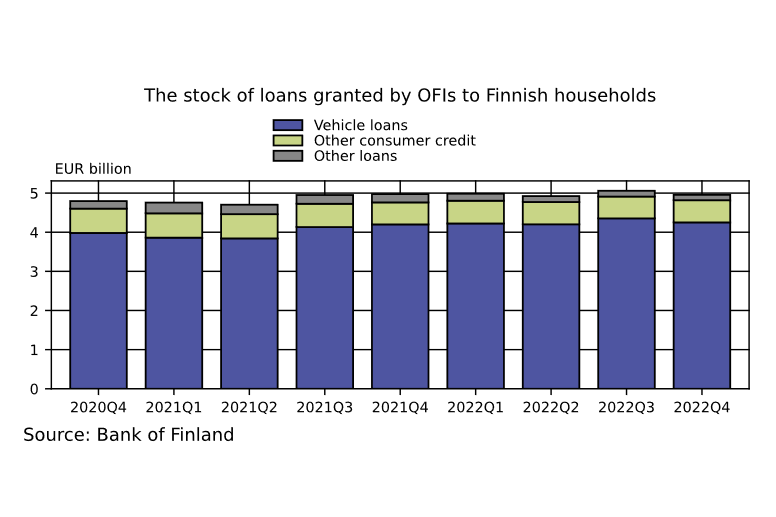

The aggregate stock of consumer credit granted by OFIs was EUR 4.9 billion at the end of 2022. Consumer credit granted by OFIs account for 19% of households’ total stock of credit (EUR 25.1 billion). The majority (68%) of households’ consumer credit has been originated by banks (credit institutions).

The majority (88%) of consumer credit originated by OFIs consisted of vehicle loans.

At present, vehicle loans constitute a more important part of OFIs’ business than before. As regards market share measured as a proportion of the loan stock, at the end of December 2022, OFIs accounted for 56% and banks for 44% of all vehicle loans (EUR 7.6 billion).

Finnish households drew down a total of EUR 1 billion of new vehicle loans from OFIs during the last quarter of 2022. The amount of vehicle loans drawn down from credit institutions in the same period was EUR 375 million. Hence, the total amount of vehicle loans drawn down in the last quarter of 2022 was EUR 1.4 billion. The agreed annual interest rate (3.4%) on new vehicle loans drawn down from OFIs in the last quarter of 2022 was lower than the interest rate on vehicle loans from credit institutions (4.7%). Likewise, the effective annual interest rate, which also includes other expenses,[3] on vehicle loans granted by OFIs was lower (5.5%) in comparison to similar loans granted by banks (6.8%).

THE STOCK OF LOANS GRANTED BY OFIS TO FINNISH NON-FINANCIAL CORPORATIONS AND HOUSEHOLDS, 2022Q4:

|

|

Non-financial corporation loans (EUR million) |

Household loans (EUR million) |

|

Secured |

1,772 |

4,250 |

|

Unsecured and with collateral deficit |

3,821 |

600 |

|

Total |

5,593 |

4,850 |

For further information, please contact:

Tommi Salenius, tel. +358 09 183 2156, email: tommi.salenius(at)bof.fi

Markus Aaltonen, tel. +358 9 831 2395, email: markus.aaltonen(at)bof.fi

The next Other financial institutions release will be published in autumn 2023.

Name & Shame process:

Financial corporations intentionally dropping out of the OFI statistics for the period 2022Q4:

SAV-Rahoitus Oyj (2022Q3-2022Q4)

Aputoiminimet / Bifirma / Auxiliary company name:

SAVOY-Rahoitus

Suomen Asuntovakuus

Suomen Automaailma

Suomen Autovakuus

GF Money Consumer Finance Oy (2022Q3)

Nordfin Capital Oy (2022Q4)

[1] Excl. pawnshops.

[2] At the end of 2021, the stock stood at EUR 214 million and the average interest rate was over 40%.

[3] In the OFI data collection, effective annual interest rate refers to new drawdowns, while in banking statistics, it refers to new agreements.