Mediation of loan-based crowdfunding to non-financial corporations declined from the peak year 2021

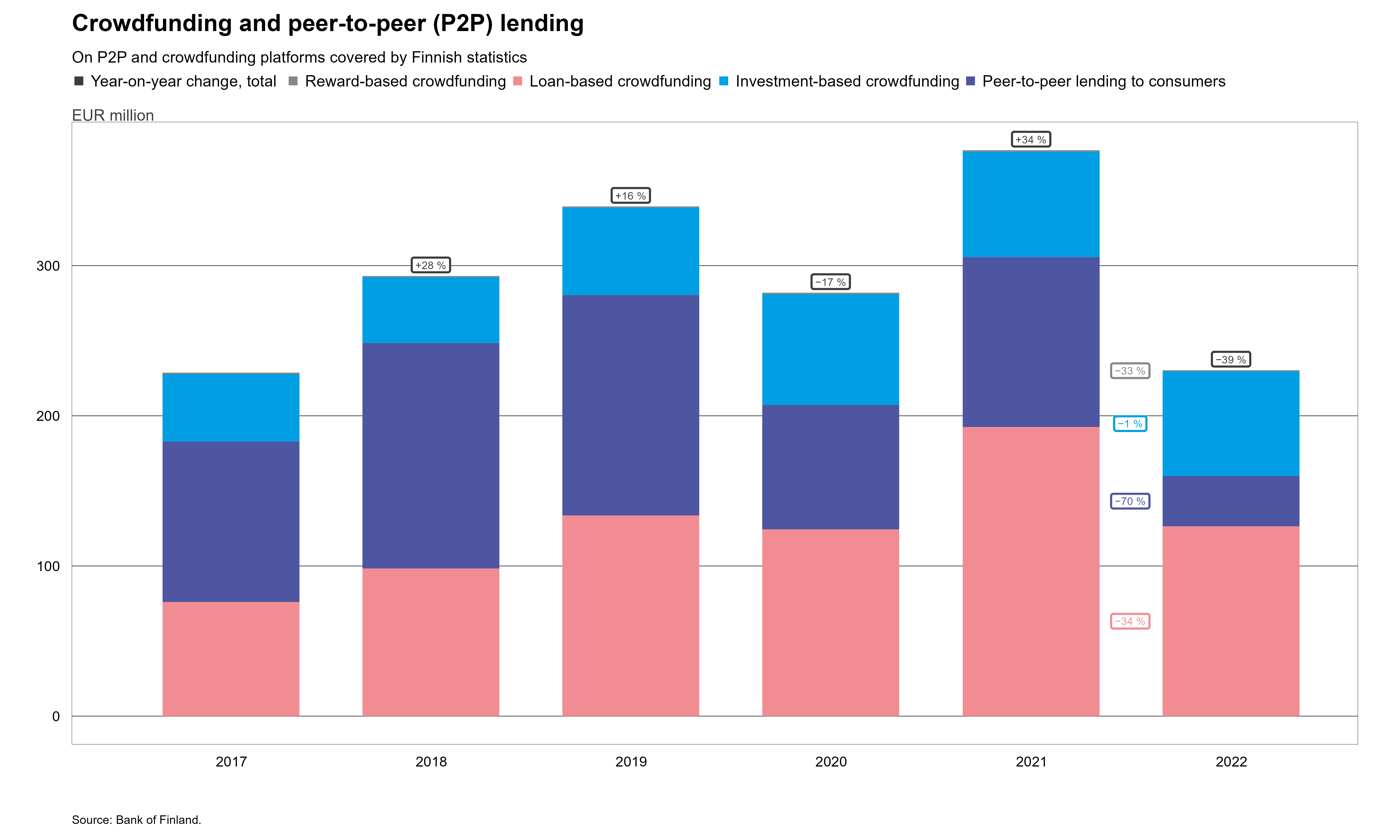

The volume of loan-based crowdfunding mediated to Finnish non-financial corporations amounted to EUR 126.4 million. This is approximately 34% less than in the peak year 2021. The volume in 2022 was close to the EUR 125.2 million mediated on average in 2017–2022.

At the same time, the number of projects funded has risen considerably. The number of successfully completed funding projects in 2022 was over 26,100, as opposed to a good 17,200 in 2021. The average loan size in loan-based crowdfunding[1] decreased clearly from 2021.

The average effective interest rate of loans mediated rose slightly from a year earlier (9.0%) to 10.6%. The average maturity of the loans increased from 2021 by about 5 months, to stand at 18 months in 2022. Nevertheless, the average maturity was clearly shorter in comparison to loans of up to EUR 50,000 granted by credit institutions to non-financial corporations, where the average maturity in 2022 was approximately 43 months.

Volume of investment-based crowdfunding was close to previous year's level

The volume of funding mediated in the form of investment-based crowdfunding was broadly the same as in 2021. Investment-based crowdfunding to domestic seekers of finance totalled EUR 69.8 million in 2020, which is EUR 0.4 million less than in 2021. The number of projects funded has also decreased. In 2022, a total of 17 funding rounds were completed successfully, as opposed to 26 rounds a year earlier. At the same time, the average size of project has increased.

Volume of P2P loans mediated to private individuals decreased considerably

In 2022, P2P loans mediated to Finnish consumers amounted to EUR 33.5 million, or 70% less than a year earlier. This is the lowest volume in the history of the statistics starting in 2017. The average P2P loan mediated in 2022 was approximately EUR 900, which was EUR 2,800 less than in 2021. A total of 30% of P2P loans extended to private individuals comes from other consumers, with the remainder coming from other investors. The share of funding from other consumers has decreased in recent years: in 2020 other consumer accounted for 53%.

The average interest rate on loans mediated to private individuals declined slightly from a year earlier. On average, consumers paid an interest of approximately 13.6% on loans taken out in 2022. The operating conditions of the P2P loan markets have tightened in recent years for example owing to the temporary interest rate caps, and therefore fewer and fewer companies offer P2P loans in Finland any more. The number of companies mediating P2P loans has been declining throughout the history of the statistics.

Volume of reward-based crowdfunding raised was low

The volume of reward-based crowdfunding mediated in Finland was low in comparison to other forms of crowdfunding. In 2022, the volume totalled EUR 0.7 million, which is broadly the same as a year earlier.

Funding volumes mediated in Finland through different forms of crowdfunding*

|

|

2020, EUR million (12-month change) |

2021, EUR million (12-month change) |

2022, EUR million (12-month change) |

|

Loan-based crowdfunding |

124.4 (-7%) |

192.5 (55%) |

126.4 (-34%) |

|

Investment-based crowdfunding |

73.7 (27%) |

70.2 (-5%) |

69.8 (-1%) |

|

Reward-based crowdfunding |

1.0 (30%) |

1.0 (-4%) |

0.7 (− 33%) |

|

Peer-to-peer lending to consumers |

82.8 (-44%) |

113.2 (37%) |

33.5 (-70%) |

|

Total |

282.0 (-17%) |

376.9 (34%) |

230.4 (-39%) |

* The figures include domestic parties seeking finance.

For further information, please contact:

Usva Topo, tel. +358 9 183 2056, email: usva.topo(at)bof.fi,

Tuomas Nummelin, tel. +358 9 183 2373, email: tuomas.nummelin(at)bof.fi.

[1] The figures also include loans mediated for factoring.