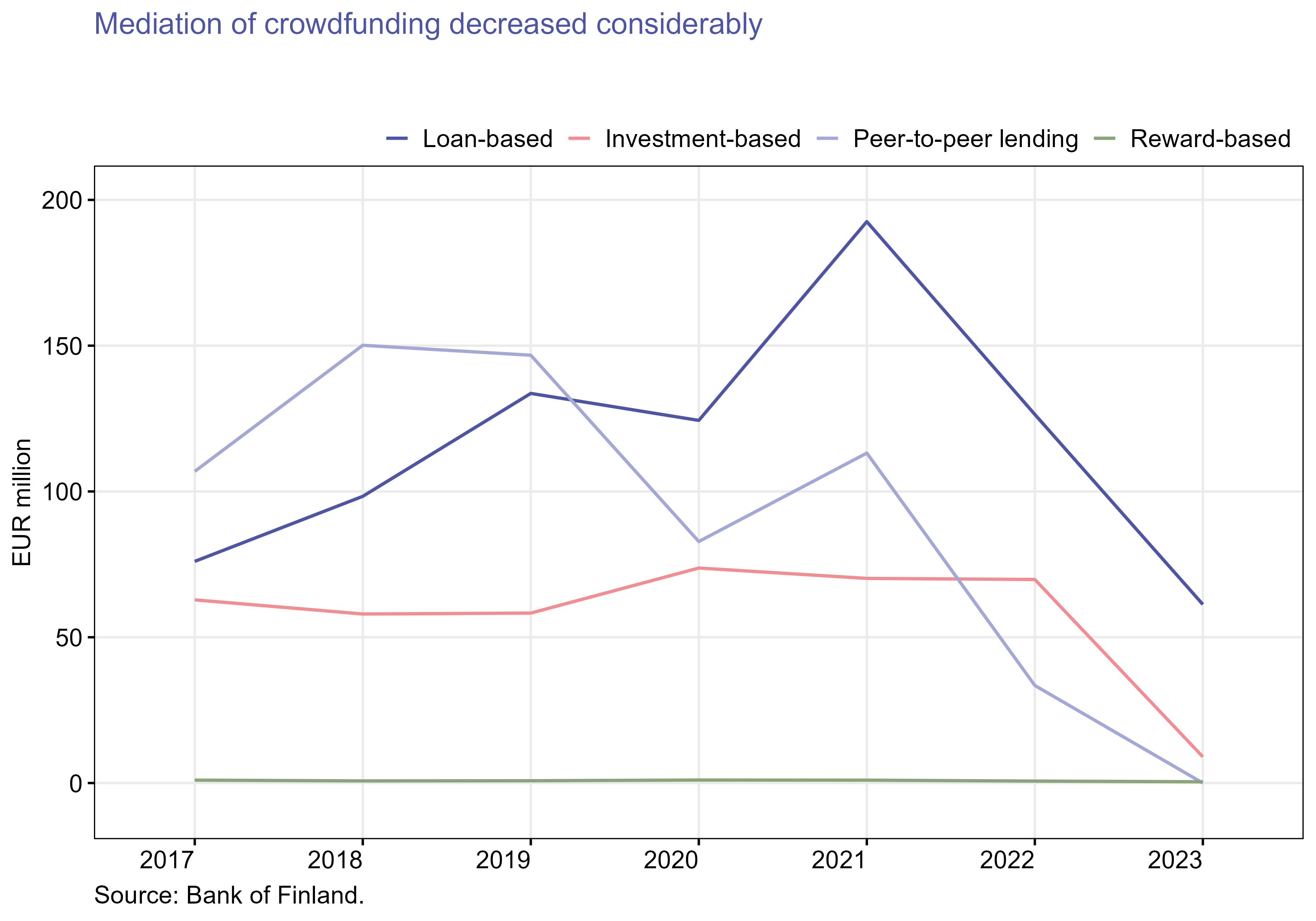

In 2023, the volume of funding mediated to domestic consumers and non-financial corporations on crowdfunding platforms covered by Finnish statistics amounted to EUR 70.7 million. This was the lowest volume in the history of the statistics (2017–2023). The volume of peer-to-peer (P2P) lending and loan-based crowdfunding decreased significantly (69.3%) from 2022. P2P loans were no longer granted to private individuals.

Volume of loan-based crowdfunding mediated to non-financial corporations decreased by more than a half year-on-year

In 2023, loan-based crowdfunding mediated to Finnish non-financial corporations amounted to EUR 61.3 million. This was about 51.5% less than in 2022 and 68.2% less than in the peak year 2021.

At the same time, the number of projects funded has collapsed. Successful funding projects completed in 2023 amounted to a good 400. The average loan amount in loan-based crowdfunding[1] decreased clearly from 2022. The average loan amount per project was about EUR 140 thousand in 2023.

The average effective annual interest rate on loans intermediated rose slightly from a year earlier (10.6%) to stand at 11.4% in 2023. The average maturity of the loans increased from 2022 by about 3 months to stand at 21 months in 2023. Nevertheless, the average maturity was clearly shorter in comparison to loans of up to EUR 50,000–250,000 granted by credit institutions to non-financial corporations, whose average maturity in 2023 was approximately 52 months.

Volume of investment-based crowdfunding drawn down decreased by 87% year-o-year

The volume of funding in the form of investment-based crowdfunding collapsed in comparison to 2022. Investment-based crowdfunding mediated to domestic seekers of finance totalled EUR 9.0 million in 2020, which was EUR 60.8 million less than in 2022. In 2023, just 5 funding rounds were completed, as opposed to 17 successful rounds a year earlier. At the same time, the average size of funded projects was also significantly smaller.

P2P loans no longer granted to private individuals

P2P loans were no longer mediated to private individuals in 2023[2]. In 2022, P2P loans mediated to Finnish consumers still amounted to EUR 33.5 million, or 70% less than a year earlier. This was the lowest volume in the history of the statistics starting in 2017. The peak in P2P loans granted was in 2018, at about EUR 150.1 million.

Volume of reward-based crowdfunding raised was low

The volume of reward-based crowdfunding mediated in Finland remained low in comparison with other forms of crowdfunding. In 2023, it totalled EUR 0.4 million, about a third less than a year earlier.

Funding volumes mediated in Finland through different forms of crowdfunding*

|

|

2021, EUR million (12-month change) |

2022, EUR million (12-month change) |

2023, EUR million (12-month change) |

|

Loan-based crowdfunding |

192.5 (55%) |

126.4 (−34 %) |

61.3 (−52 %) |

|

Investment-based crowdfunding |

70.2 (-5%) |

69.8 (−1 %) |

9.0 (−87 %) |

|

Reward-based crowdfunding |

1.0 (-4%) |

0.7 (−33 %) |

0.4 (−34 %) |

|

Peer-to-peer lending to consumers |

113.2 (37%) |

33.5 (−70 %) |

0 (−100 %) |

|

Total |

376.9 (34%) |

230.4 (−39 %) |

70.7 (−69 %) |

* The figures comprise domestic parties seeking finance.

For further information, please contact:

Usva Topo, tel. +358 9 183 2056, email: usva.topo(at)bof.fi,

Tuomas Nummelin, tel. +358 9 183 2373, email: tuomas.nummelin(at)bof.fi.

[1] The figures also include loans intermediated for factoring.

[2] The reporting population did not include any entities providing new P2P loans to consumers in 2023.