Deposits grew on transaction accounts

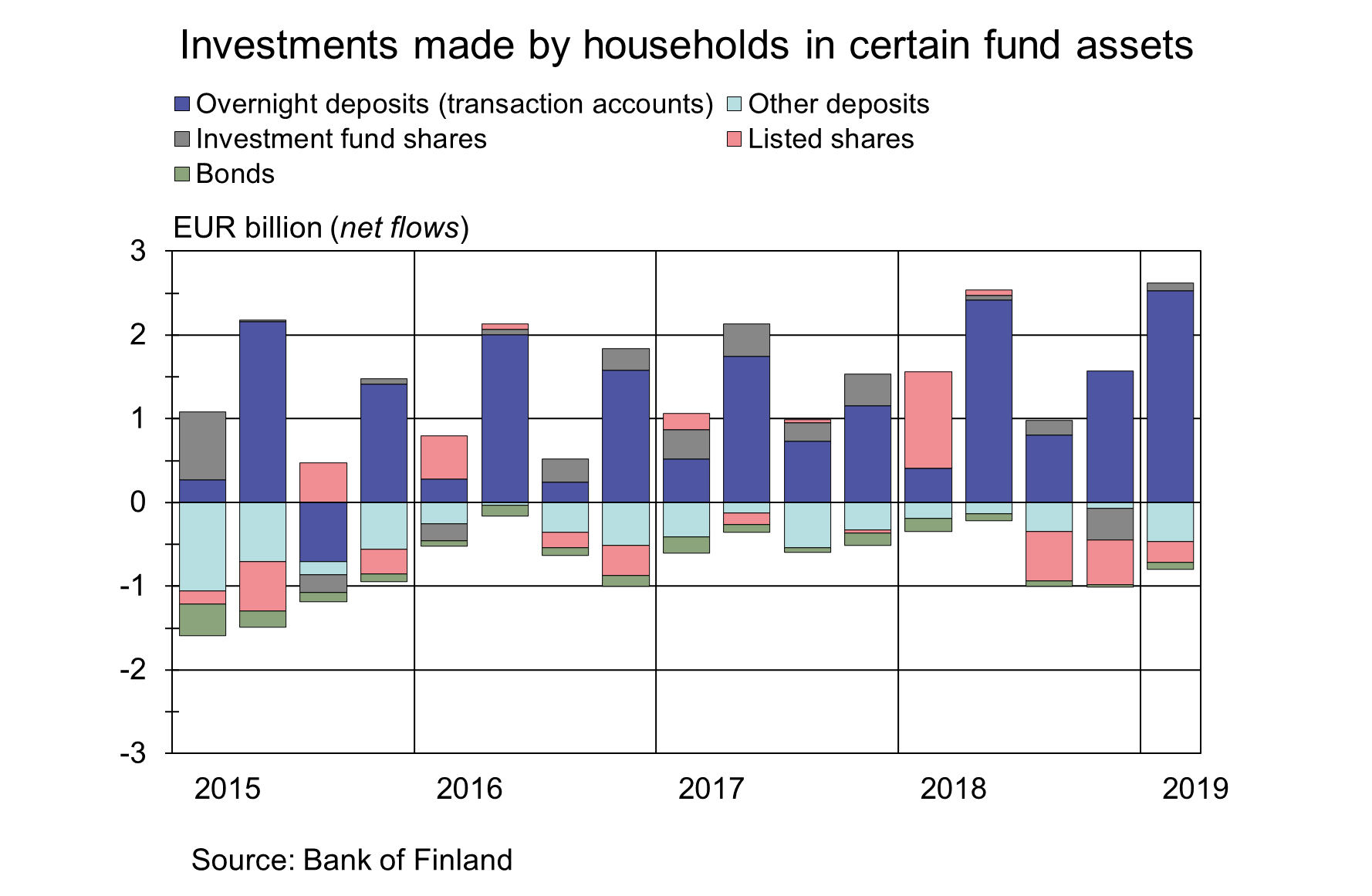

Households' stock of deposits grew by EUR 2.1 billion in the first quarter of 2019. Financial assets on transaction accounts grew most. In March 2019, EUR 78.4 billion of Finnish households’ financial assets was held on transaction accounts. Households’ stock of deposits with agreed maturity continued to contract, by EUR 0.6 billion in the first quarter of 2019, and accounted for only 5.4% of households’ stock of deposits at the end of March 2019. In total1, Finnish households had deposits valued at EUR 91.2 billion at the end of March 2019.

Value of shareholdings grew

The stock of listed shares held by Finnish households amounted to EUR 35.7 billion at the end of March 2019. Households sold a net EUR 248 million of listed shares during the first quarter of 2019. Due to favourable development in stock market prices, the value of households’ shareholdings grew by EUR 3 billion over the same period. Domestic non-financial corporations accounted for 92% of households’ investments in shares.

Households owned bonds valued at EUR 2.5 billion at the end of March 2019. Households’ bond holdings have declined steadily in recent years.

Households own a significant proportion of domestic investment funds

Household investments in investment funds registered in Finland amounted to EUR 22.3 billion at the end of March 2019. The value of fund shares held by households grew by EUR 1.5 billion in the first quarter of 2019. Household investments in equity funds increased most in value (EUR 0.8 billion). In addition, households invested a net EUR 92 million more in investment funds during the first quarter of 2019.

At the end of March 2019, households were invested most in bond funds (EUR 8.1 billion), followed by equity (EUR 7.8 billion) and mixed funds (EUR 4.3 billion). Real estate funds have increased in popularity among households in recent years. Households had investments of EUR 1.8 billion in real estate funds at the end of March 2019. In addition to domestic fund investments, households had investments of EUR 2.3 billion in foreign investment funds2 at the end of March 2019.

Households’ assets are also channelled into investment funds via unit-linked insurance policies offered by insurance companies. Fund units indirectly held by households through this vehicle are estimated at EUR 24 billion, of which around EUR 20 billion is in domestic investment funds. Taking into account direct and indirect fund investments, households hold a significant share of the EUR 117.7 billion total stock of investment funds registered in Finland.

1Overnight deposits, deposits with agreed maturity and investment deposits

2which are held in custody in Finland.

Finnish deposits and investments, 2019Q1

| All | Households | Employment pension schemes | ||||

| EUR million, stock (flows) | EUR million, change in valuation | EUR million, stock (flows) | EUR million, change in valuation | EUR million, stock (flows) | EUR million, change in valuation | |

| Finnish investments | ||||||

| Listed shares | 183 802 | 17 497 | 35 688 | 2 989 | 28 933 | 2 998 |

| (4 826) | (-248) | (-262) | ||||

| - in domestic shares | 122 908 | 10 971 | 32 702 | 2 805 | 15 891 | 1 559 |

| (3 561) | (-262) | (154) | ||||

| Bonds | 198 784 | 3 015 | 2 499 | 47 | 36 655 | 958 |

| (-2 460) | (-78) | (-987) | ||||

| - in domestic bonds | 69 656 | 714 | 1 656 | 39 | 4 535 | 53 |

| (3 109) | (-50) | (464) | ||||

| Fund shares | ||||||

| Domestic investment funds | 92 282 | 5 698 | 22 337 | 1 463 | 5 708 | 318 |

| (-823) | (92) | (-110) | ||||

| Equity funds | 32 774 | 3 701 | 7 815 | 846 | 2 068 | 234 |

| (-1 271) | (-13) | (-154) | ||||

| Bond funds | 42 768 | 1 224 | 8 073 | 295 | 3 224 | 80 |

| (2 735) | (130) | (611) | ||||

| Mixed funds | 10 486 | 748 | 4 280 | 303 | 44 | 0 |

| (48) | (18) | (30) | ||||

| Real-estate funds | 4 853 | 15 | 1 828 | 13 | 297 | 7 |

| (305) | (104) | (0) | ||||

| Other funds (money market, hedge, other funds) | 1 401 | 10 | 341 | 7 | 75 | -3 |

| (-2 640) | (-146) | (-598) | ||||

| Foreign funds | 135 255 | 8 816 | 2 294 | 215 | 96 286 | 6 263 |

| (1 462) | (84) | (815) | ||||

| Finnish bank deposits | ||||||

| Transaction accounts | 146 211 | 34 | 78 392 | 4 | 5 214 | 7 |

| (1 258) | (2 527) | (-2 074) | ||||

| Agreed maturity | 39 921 | 2 | 4 917 | 0 | 179 | 0 |

| (280) | (-582) | (-28) | ||||

For further information, please contact:

Antti Alakiuttu, tel. +358 9 183 2495, email: antti.alakiuttu(at)bof.fi.

Related statistical data and graphs are also available on the Bank of Finland website: https://www.suomenpankki.fi/en/Statistics/saving-and-investing/.

The next Savings and investing news release will be published at 1 pm on 12th of August 2019.