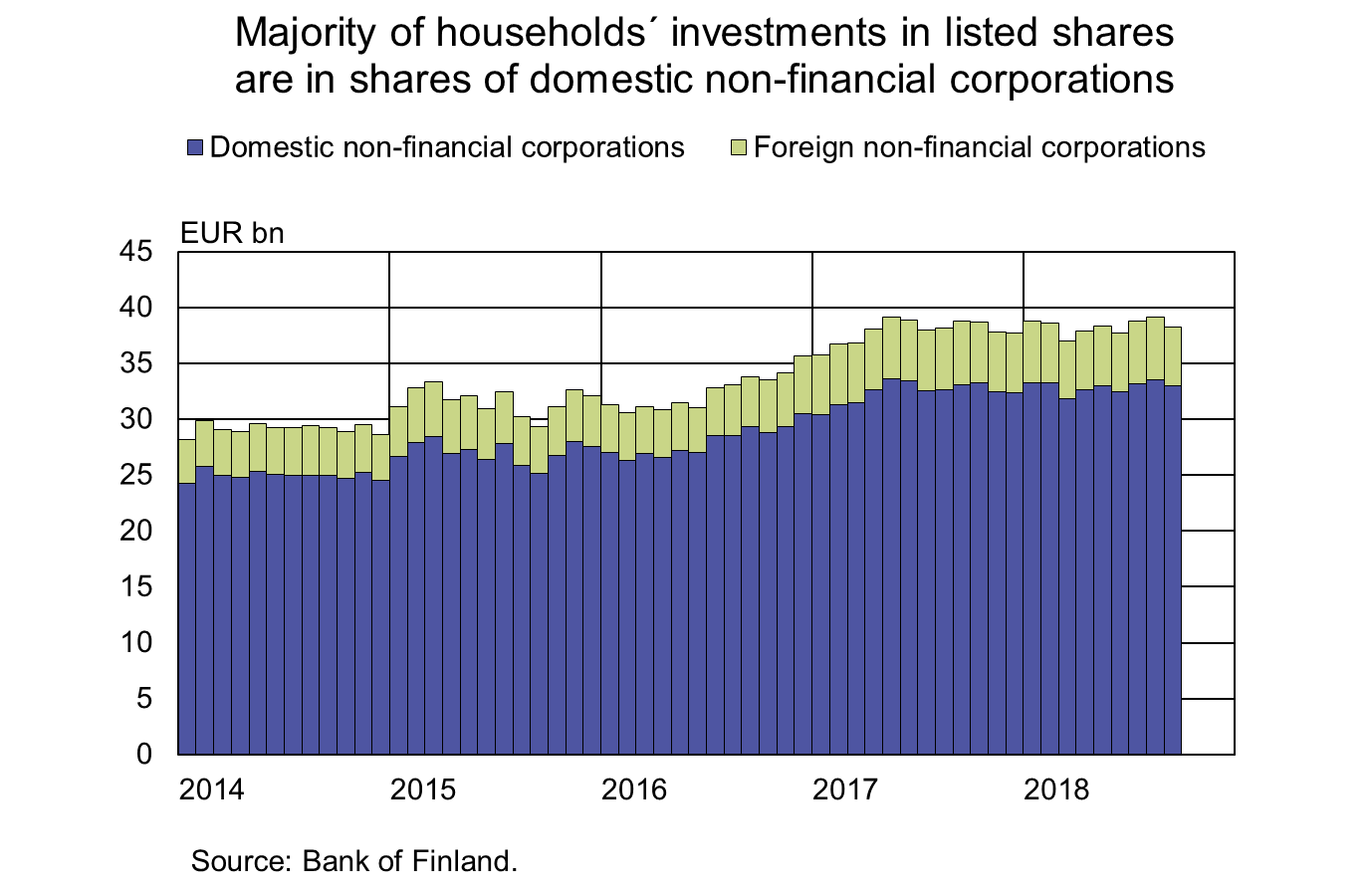

The stock of listed shares held by Finnish households declined by EUR 900 million on August, to EUR 38.2 billion at end-September 2018. The decline is largely attributable to the sale of shares by households. In September 2018, households’ net sales of shares clearly exceeded net purchases, totalling EUR –560 million. In the same period, the value of households’ shareholdings declined by EUR 310 million. In September 2018, domestic non-financial corporations accounted for 86% of households’ investments in listed shares, followed by Swedish non-financial corporations (9%).

A significant portion of household equity is also channelled indirectly to shares through investment vehicles. Finnish households’ direct holdings in domestic investment funds amounted to EUR 22.6 billion at end-September 2018. According to an estimate by the Bank of Finland, households’ holdings of listed shares via these investment funds amount to EUR 10.6 billion. Households’ assets are also channelled to investment funds and thus to shares via unit-linked insurance policies offered by insurance companies. Households’ shareholdings through this vehicle are almost as large as shareholdings via investments in investment funds.

Securities issues statistics

Finnish residents issued EUR 5.9 billion worth of bonds in the third quarter of 2018. With bond redemptions amounting to EUR 12.0 billion, net issuance of bonds in July–September 2018 totalled EUR–6.1 billion. At end-September 2018, the stock of bonds issued by Finnish residents amounted to EUR 218 billion and the annual growth rate of the stock was 3.9%. Bonds issued by central government (EUR 100 billion) and monetary financial institutions (EUR 75 billion) account for over 80% of the total bond stock.

Net issuance of bonds by Finnish non-financial corporations¹ totalled EUR –1.1 billion in the third quarter of 2018. New corporate bond issuance in July–September 2018 amounted to EUR 190 million and redemptions to EUR 1.3 billion. At end-September 2018, the stock of bonds issued by Finnish non-financial corporations amounted to EUR 27 billion and the annual growth rate of the stock was – 2.7%.

Securities holdings statistics

At end-September 2018, the stock of securities investments by employee pension institutions amounted to EUR 177 billion. The stock increased by EUR 2 billion in the third quarter of 2018. In July–September 2018, employee pension institutions made EUR –240 million worth of new investments in securities. In the same period, the value of investments rose by EUR 2.3 billion. At end-September 2018, the majority (EUR 100 billion) of employee pension institutions’ investments were in investment funds, of which EUR 92 billion were in foreign funds and EUR 8 billion in domestic funds.

¹Non-financial corporations (S.111) excl. monetary financial institutions and financial institutions.

For further information, please contact

Markus Aaltonen, tel. +358 9 183 2395, email: markus.aaltonen(at)bof.fi.

Related statistical data and ‑graphs are also available on the Bank of Finland website: https://www.suomenpankki.fi/en/Statistics/securities-statistics/.