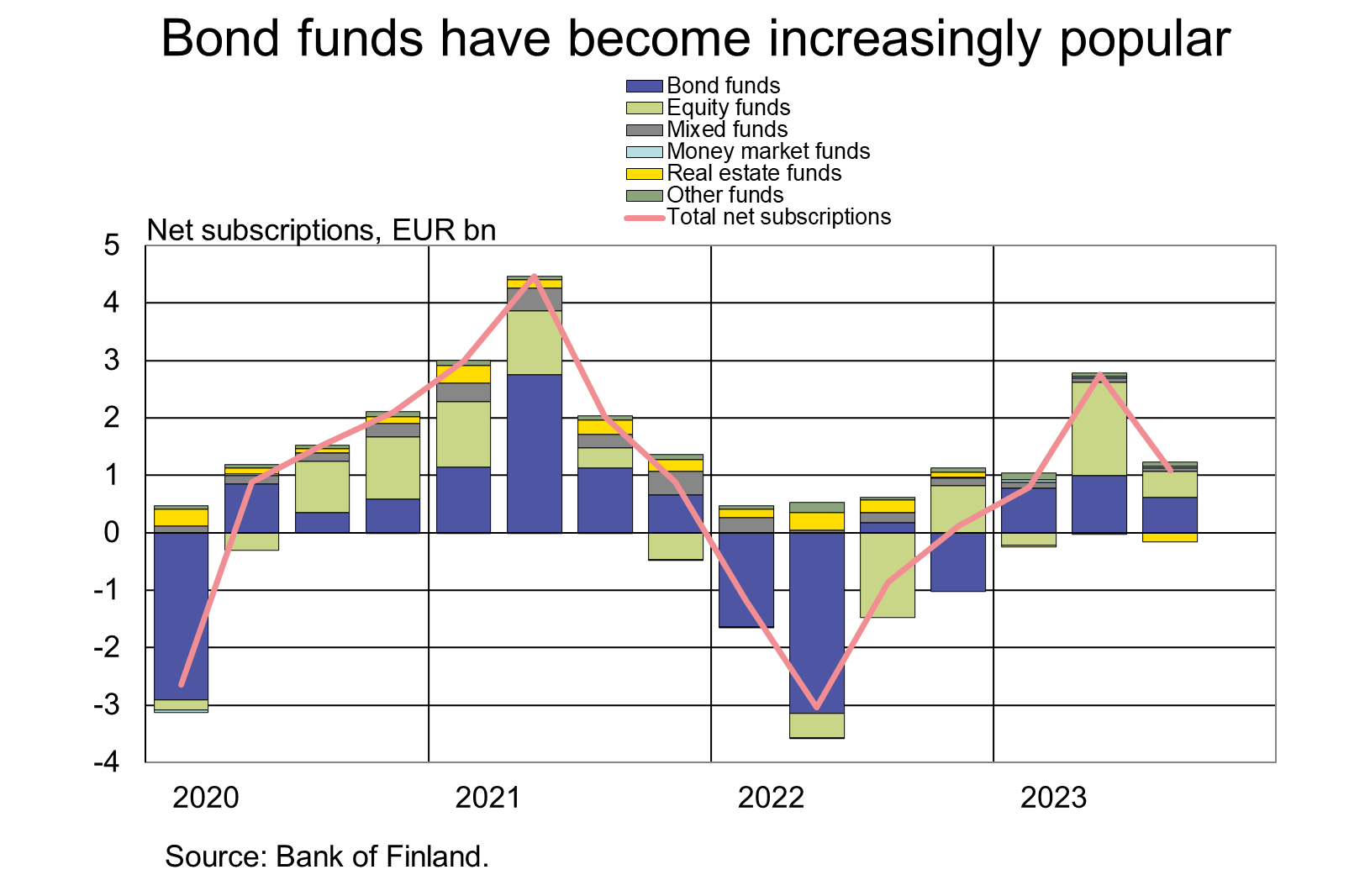

Up until 2022, clearly the largest redemptions[1] were made from bond funds. This trend has turned in 2023. In January–September 2023, the largest subscriptions were made from bond funds. During the period, new subscriptions in bond funds amounted to EUR 13.6 billion and redemptions to EUR 11.3 billion. Hence, net subscriptions in bond funds were EUR 2.4 billion. Most of the net subscriptions in bond funds were made in short-term bond funds (76%).

In January–September 2023, the second-largest net subscriptions were made in equity funds (EUR 1.9 billion). In the same period, only real estate funds had more redemptions than subscriptions. Net redemptions from real estate funds totalled EUR -200 million, whereas still in 2022, real estate funds received the largest net subscriptions.

In January–September 2023, the largest subscriptions[2] (EUR 2.2 bn) in Finnish investment funds were made by households. Finnish households accounted for 63% of this amount.

In 2022, investment funds’[3] fund capital contracted materially, to stand at EUR 137.5 billion at the end of the year. In January–September 2023, the fund capital has grown again. At the end of September 2023, it stood at EUR 146.3 billion. The growth in 2023 is explained by both new investments (EUR 4.7 billion) and growth in the value of fund capital (EUR 4.1 billion). The growth in value is mainly explained by the appreciation of equity investments.

At the end of September 2023, the fund capital of equity funds totalled EUR 63.5 billion, compared to EUR 54.8 billion in bond funds. Equity and bond funds together account for 81 % of investment funds’ total fund capital. The next largest fund types by capital are mixed funds and real estate funds.

Most of bond funds’ investments were allocated abroad

At the end of September 2023, 24% of bond funds’ aggregate investments of EUR 55.7 billion were allocated to Finland and 76% abroad.

The majority (44%) of domestic investments were inter-fund investments, while 33% of the investments were made directly in bonds, over half of which were issued by non-financial corporations (NFCs).

Bond funds’ largest foreign investments were made in Sweden (EUR 6.7 billion) and Luxembourg (EUR 6.4 billion). Of the foreign investments, 78% were made in bonds – 32% of which were issued by NFCs and 27% by banks.

Finnish households are the largest owner of investment funds

At the end of September 2023, Finnish households had direct fund unit holdings worth EUR 32.1 billion in Finnish investment funds, which is 7% more than at the end of 2022. Households held their largest investments in equity funds (EUR 12.8 billion) and the second largest in bond funds (EUR 8.8 billion). A large volume of Finnish households’ assets is also channelled to domestic investment funds through unit-linked policies with insurance corporations. In the Bank of Finland's investment fund statistics, these are shown as insurance corporations’ investments.

| Finnish deposits and investments (EUR million), 2023Q3 | ||||||

| All** | Households | Employment pension schemes | ||||

| stock (flows) | change in valuation | stock (flows) | change in valuation | stock (flows) | change in valuation | |

| Finnish investments | ||||||

| Listed shares | 202 578 | -8 214 | 42 468 | -2 077 | 33 861 | -1 001 |

| (413) | (-397) | (232) | ||||

| - in domestic shares | 115 622 | -6 213 | 37 207 | -1 865 | 15 918 | -585 |

| (-416) | (-549) | (111) | ||||

| Bonds | 212 677 | -828 | 1 280 | -1 | 29 334 | -196 |

| (-4 533) | (-47) | (-277) | ||||

| - in domestic bonds | 92 859 | -777 | 780 | -2 | 4 765 | -30 |

| (-5 391) | (-14) | (71) | ||||

| Fund shares | ||||||

| Domestic investment funds | 112 642 | -948 | 32 114 | -398 | 5 155 | -12 |

| (1 080) | (485) | (-40) | ||||

| Foreign funds | 174 255 | 1 370 | 5 920 | -120 | 128 515 | 1 683 |

| (818) | (182) | (-408) | ||||

| Finnish bank deposits | ||||||

| Overnight deposits (transaction accounts) | 142 936 | 71 | 74 555 | 8 | 3 635 | 5 |

| (-9 533) | (-3495) | (-522) | ||||

| Other deposits | 44 444 | 6 | 35 555 | 0 | -* | -* |

| (3 572) | (2720) | -* | ||||

* Confidential.

** Insurance corporations' securities and mutual fund information is missing.

For further information, please contact:

Markus Aaltonen, tel. +358 9 831 2395, email: markus.aaltonen(at)bof.fi,

Ville Tolkki, tel. +358 9 183 2420, email: ville.tolkki(at)bof.fi.

Related statistical data and graphs are also available on the Bank of Finland website: https://www.suomenpankki.fi/en/statistics2/.

The next news release on saving and investing will be published at 10 am on 8 February 2024.

[1] In 2022, net redemptions from bond funds amounted to EUR 5.6 billion.

[2] Net subscriptions.

[3] Including UCITS and non-UCITS investment funds registered in Finland.