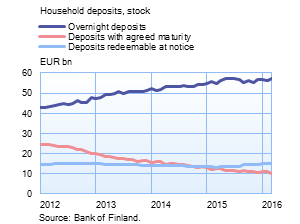

Households have for a long time already shown little interest in deposits with agreed maturity. In March 2016, the stock of deposits with agreed maturity fell below EUR 10 bn, the lowest level in nearly 16 years. The popularity of deposits with agreed maturity has been eroded by the decline in the interest rates paid thereon. In March, new household deposits with agreed maturity were remunerated at an average interest rate of 0.7%, while the interest rate on new deposit agreements one year earlier was still slightly above 1%. Some of the deposits with agreed maturity are structured deposits, in which part of the total interest paid is linked to the value of an external indicator such as movements in stock prices. The demand for these deposits has also faded; their share in deposits with agreed maturity has fallen to a nearly marginal level. While the popularity of deposits with agreed maturity has been fading, households' redeemable and overnight deposits have increased. During the past 12 months, overnight deposits have increased by EUR 3.2 bn and redeemable deposits by EUR 0.8 bn. At the end of March 2016, the stock of redeemable deposits, comprising different types of savings accounts, was EUR 14.9 bn, which was the highest level in three years. |

|

Loans New drawdowns of loans to non-financial corporations (excl. overdrafts and credit card credit) amounted to EUR 2.2 bn in March. The average interest rate on new corporate-loan drawdowns declined from February, to 1.76%. At the end of March, the stock of euro-denominated loans to non-financial corporations was EUR 73.3 bn, of which loans to housing corporations accounted for EUR 23.8 bn. |

Deposits At the end of March, the stock of household deposits totalled EUR 81.9 bn, and the average interest rate on the deposits was 0.26%. Overnight deposits accounted for EUR 57.1 bn and deposits with agreed maturity for EUR 10.0 bn of the total deposit stock. In March, households concluded EUR 0.6 bn of new agreements on deposits with agreed maturity.

|

Key figures of Finnish MFIs' loans and deposits, preliminary data

| January, EUR million | February, EUR million | March, EUR million | March, 12-month change1, % | Average interest rate, % | |

| Loans to households2, stock | 122,080 | 122,109 | 122,319 | 2,8 | 1,67 |

| - of which housing loans | 92,022 | 92,027 | 92,162 | 2,5 | 1,18 |

| Loans to non-financial corporations2, stock | 73,020 | 73,543 | 73,280 | 5,2 | 1,57 |

| Deposits by households2, stock | 82,187 | 81,401 | 81,933 | 1,9 | 0,26 |

| Households' new drawdowns of housing loans | 1,053 | 1,262 | 1,402 | 1,23 |

1 Rate of change has been calculated from monthly differences in levels adjusted for classification and other revaluation changes.

2 Households also include non-profit institutions serving households; non-financial corporations also include housing corporations.

- Euro-denominated deposits and loans of euro area residents: stock, 12 month rate of change and average interest rate

- Euro-denominated loans and deposits of Finnish households

- New business on loans and new drawdowns of household loans

- Finnish contribution to the euro area monetary aggregates and their main counterparts

For further information, please contact:

Johanna Honkanen, tel. +358 10 831 2992, email: johanna.honkanen(at)bof.fi,

Olli Tuomikoski, tel. +358 10 831 2146, email: olli.tuomikoski(at)bof.fi

The next news release will be published at 1 pm on 1 June 2016.

http://www.suomenpankki.fi/link/2331b6266da3492f832ec75e0f654bd9.aspx?epslanguage=en.